Top 5 Homeowners Insurance Claims (and Tips for Avoiding Them)

Homeowners’ insurance offers a financial safety net against many of life’s curveballs. However, each claim you file comes with a risk. Your insurance company can raise your rates, or, if you’ve filed multiple claims in a short time frame, drop your coverage entirely. To keep premiums affordable, avoid filing small claims, and take precautions to reduce the chances of loss.

Here are the 5 most common homeowners insurance claims and how to prevent them so that you’ll have the coverage you need at a price you can afford.

Wind and Hail Claims

Weather-related damage from wind and hailstorms consistently tops the list of homeowner insurance claims, according to the Insurance Information Institute (iii). Roof damage from falling trees and hail damage are typically covered, but flood damage is almost always excluded. Check with your insurance partner to make sure you have the right coverage for your home and needs.

As we’ve seen in recent years, the damages from a natural disaster can be devastating, but these precautions can help lower your risk:

- Inspect the trees in your yard once a year. If you see dead branches or branches hanging too closely to your home, remove them.

- Park your vehicles in a covered area during strong storms.

- Move outdoor furniture indoors. This will prevent wind from blowing them into your home or other structures.

- Check the condition of the roof shingles at least once a year.

Water Damage and Freezing Claims

Claims related to water damage and freezing take the second spot (although fire and lightning claims tend to be much more severe). Frozen water pipes can cause major property damage, especially if the pipes burst. Your policy likely covers damages from burst pipes, as well as water heater and AC unit leaks—with one serious caveat. Insurance policies exclude water damage caused by an appliance that’s either not maintained or at the end of its life. Slow leaks are also excluded as they fall under maintenance.

Follow this checklist to reduce your risk of water damage:

- Inspect appliances twice a year for signs of leaks, moisture, mold or corrosion.

- Insulate pipes to help prevent freezing and bursting during winter.

- Know how to shut off your water main quickly, or consider installing an auto-shutoff device that can turn off your water main for you if it detects a leak.

- Have your furnace inspected by a professional before the heating season, especially the surrounding pipes that carry hot water.

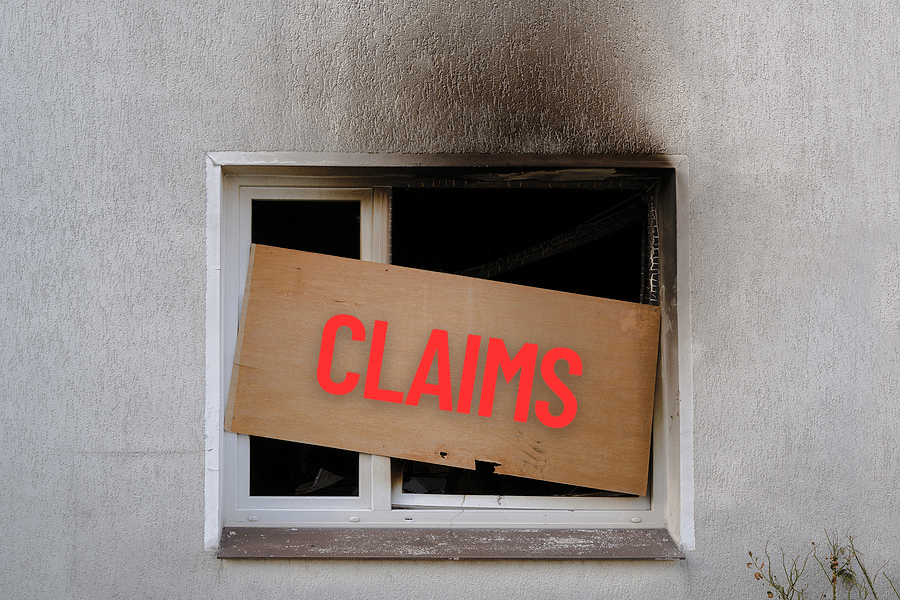

Fire and Lightning Claims

Depending on the year, claims from fires and lightning strikes may trade places with water-related claims for frequency, but these claims tend to be the biggest. The average loss in fire-related claims is around $84K, compared to $13.5K and $14K for wind/hail and water/freezing damage, respectively.

Many residential fires happen during meal preparation. When you’re cooking or baking, note which burners are in use and monitor what’s in the oven. Also, don’t leave the stove unattended (or put pizza boxes on the cooktop).

In addition, the following tips can prevent common causes of house fires:

- Make sure all appliances are well-maintained. Check your stove, refrigerator, and dishwasher once a year for needed repairs.

- Avoid overloading electrical circuits with too many appliances or adapters.

- If you light a candle or use your fireplace, extinguish all flames before you leave your home or go to sleep.

- In addition to cleaning the dryer lint trap after every use, clean the dryer vent—or have a professional do it—at least once per year.

- Clear out any chimney blockages before winter.

Lightning-related claims are less common than fires, although fires are a common consequence of lightning strikes. Still, in 2023, New York ranked eighth among the Top 10 states for homeowners insurance lightning losses, with an average price tag of $20.6K per claim.

To protect your home against lightning strikes, consider the following:

- Hire a qualified electrician to evaluate your home’s grounding system to confirm it works properly. (Not sure if your house has a grounding system? Check your outlets. If the receptacles have a third, round hole, then you probably do. If you have an older home—built before 1965—and your outlets still have two slots, it’s a good idea to update the electrical system.)

- Plug appliances and electronics into surge-protection devices (SPDs).

Burglary Claims

While break-in insurance claims are less common, they can lead to devastating losses. Theft may be out of your control, but you can make your home less attractive to thieves:

- If your car is parked in the driveway, don’t leave the garage door opener on your visor or out in the open.

- Install a security or video system. A system with central monitoring can qualify for insurance discounts.

- Turn on an energy-efficient light when you’re not home.

- If you have smart lighting—home lighting that can be controlled through an app or voice commands—these systems often have a “vacation mode” that turns lights on and off at random.

- Lock all your doors while you’re away.

Liability Claims (or Bodily Injuries on Your Property)

If a guest trips and falls while on your property or sidewalk, you could be liable for damages. You can also be liable for injuries caused by your dog. Many liability injuries can be prevented through routine maintenance and housekeeping, such as replacing rotting wood and keeping stairs free of debris.

Here are a few other ways you can avoid injuries to guests and contractors at your home:

- Repair broken planks in your deck or stairs. Watch for exposed nails.

- Block off icy paths during winter, or provide alternative ways around your property.

- Pick up toys and gardening tools when they’re not in use.

- Keep your dog leashed, and make sure your insurance provider covers your dog’s breed.

If you have any questions about homeowners’ insurance coverage or would like a free insurance review, please call us at 877-576-5200.

Comments (0)